The 15-Second Trick For Offshore Company Formation

Table of ContentsRumored Buzz on Offshore Company FormationThe 6-Second Trick For Offshore Company FormationIndicators on Offshore Company Formation You Need To KnowSome Known Facts About Offshore Company Formation.4 Easy Facts About Offshore Company Formation ShownThe Basic Principles Of Offshore Company Formation

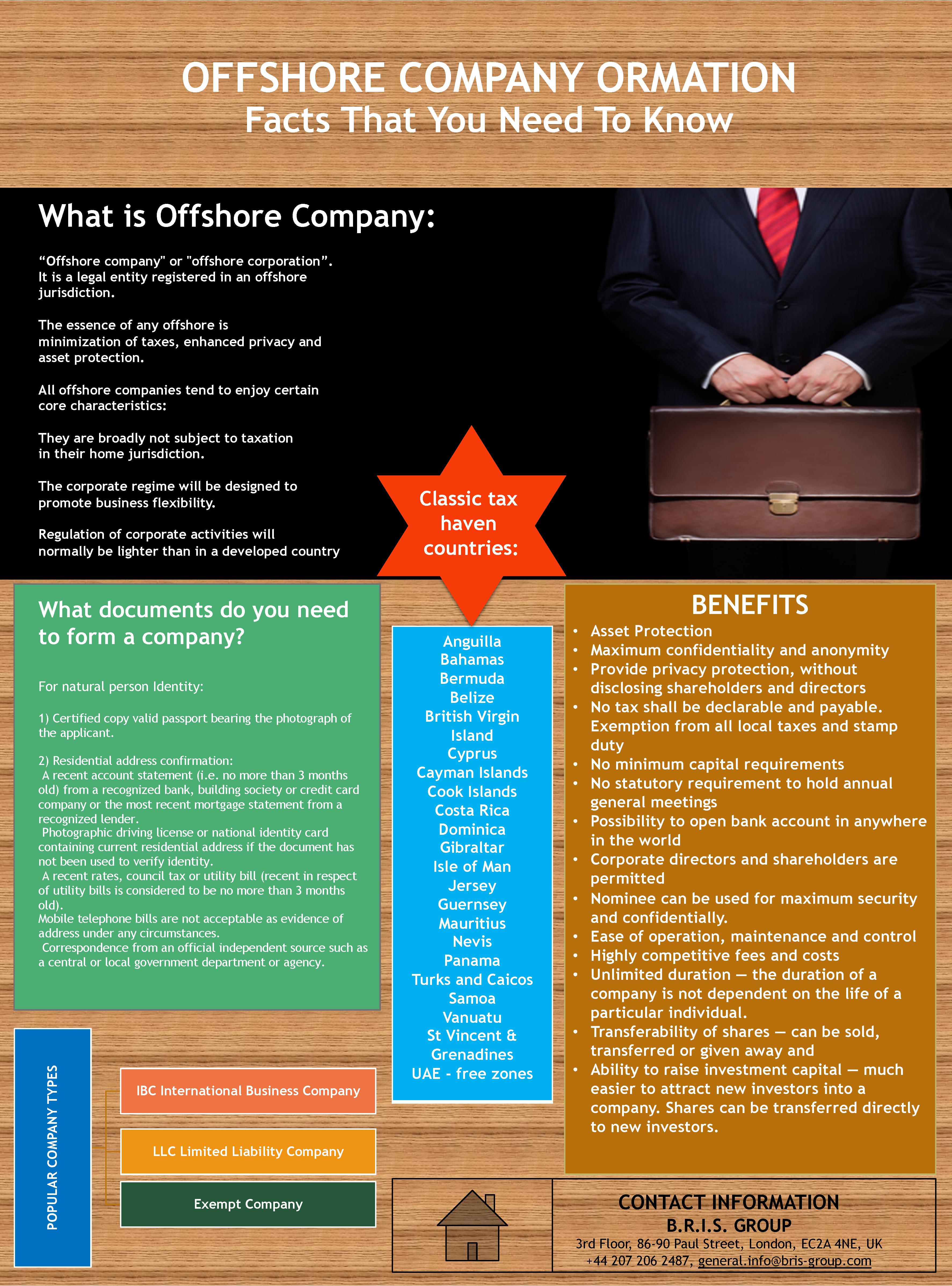

There are commonly fewer legal obligations of administrators of an overseas business. It is additionally typically simple to set up an offshore business and the process is easier contrasted to having an onshore company in many components of the world.As a matter of fact, there are various other jurisdictions that do not call for resources when signing up the company. An overseas firm can function well for numerous teams of individuals. If you are a business person, for example, you can create an overseas firm for privacy objectives as well as for convenience of management. An offshore business can additionally be made use of to execute a working as a consultant business.

Offshore Company Formation Can Be Fun For Anyone

The procedure can take as little as 15 mins. Even prior to creating an offshore firm, it is initially crucial to know why you like overseas firm formation to setting up an onshore company.

If your main goal for opening up an offshore business is for personal privacy objectives, you can conceal your names using candidate services. There are several things that you must birth in mind when picking an offshore territory.

Fascination About Offshore Company Formation

There are rather a number of overseas jurisdictions and also the entire job of coming up with the ideal one can be rather made complex. There are a number of things that you also have to place into factor to consider when selecting an offshore territory.

If you established up an offshore business in Hong Kong, you can trade internationally without paying any local tax obligations; the only condition is that you must not have an income source from Hong Kong. There are no tax obligations on resources gains and also financial investment income. The place is likewise politically as well as economically secure. offshore company formation.

With so several jurisdictions to choose from, you can always locate the very best location to develop your offshore business. It is, however, these details vital to take notice of details when developing your choice as not all companies will permit you to open up for savings account and you require to guarantee you practice appropriate tax obligation planning for your neighborhood in addition to the foreign jurisdiction.

A Biased View of Offshore Company Formation

Business structuring as well as preparation have actually attained higher degrees of intricacy than ever while the demand for privacy stays solid. Firms need to keep speed and be frequently in search of new methods to benefit. One way is to have a clear understanding of the features of offshore international corporations, as well as how they may be propounded advantageous use.

A more correct term to use would be tax reduction or preparation, because there are means of mitigating taxes without damaging the legislation, whereas tax evasion is typically categorized as a criminal offense. Yes, because the majority of countries urge international trade and also business, so there are normally no constraints on citizens doing service or having savings account in various other nations.

Not known Facts About Offshore Company Formation

Advanced as well as credible high-net-worth people and also firms routinely make use of offshore financial investment lorries worldwide. Shielding possessions in mix with a Depend on, an overseas firm can prevent high levels of revenue, funding and also fatality tax obligations that would certainly otherwise be payable if the properties were held directly. It can likewise protect assets from lenders and also other interested events.

If the company shares are held by a Depend on, the possession is legitimately vested in the trustee, therefore gaining content the potential for even better tax obligation preparation benefits. Family and Protective Trust funds (possibly as an alternative to a Will) for buildup of investment earnings and also lasting benefits for beneficiaries on a desirable tax basis (without revenue, inheritance or resources gains taxes); The sale or probate of buildings in various nations can end up being complicated and expensive.

Conduct company without corporate tax obligations. Tax obligation sanctuaries, such as British Virgin Islands, allow the development of International Companies that have no tax obligation or reporting duties.

The Basic Principles Of Offshore Company Formation

This enables the fees to collect in a reduced tax territory. a fantastic read International Companies have the exact same legal rights as an individual person and can make investments, get and also market realty, profession portfolios of stocks as well as bonds, as well as perform any kind of lawful service tasks so long as these are not done in the nation of registration.